Beckham Law vs. Mbappé Law: Two Very Different Tax Regimes"

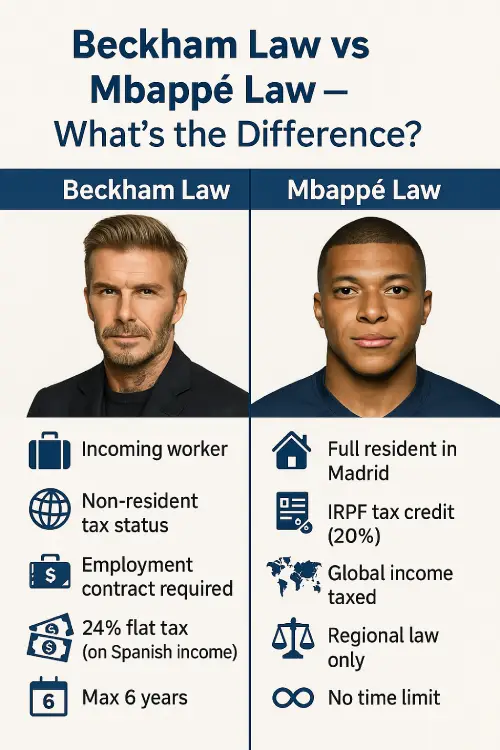

In recent months, media coverage has generated confusion between two very different tax regimes in Spain: the so-called “Beckham Law” and the new regional deduction popularly dubbed the “Mbappé Law.” While both are nicknamed after football stars, they are fundamentally different in their legal nature, scope, and applicability.

Let’s clarify this from the perspective of a Spanish tax inspector.

1. The "Beckham Law" (Special Tax Regime for Inbound Workers – Non-Residents)

Legal Reference: Article 93 of the Personal Income Tax Law (IRPF)

- PurposeTo attract foreign professionals (not only athletes) to work in Spain by allowing them to be taxed as non-residents.

- Tax Basis:Flat tax rate of 24% on Spanish-source income up to €600,000 (47% above that).

- Duration: Applies for 6 years (the year of arrival and the next 5 years).

- Who Qualifies:

- Individuals who move to Spain due to an employment contract or becoming directors of a company.

- Must not have been tax resident in Spain in the previous 5 years.

- Excluded Income: I Foreign income is not taxed (except Spanish-source income and employment income from work performed in Spain).

In short: you become a non-resident for tax purposes even though you live in Spain.

2. The "Mbappé Law" (Madrid Regional Deduction – Ley 4/2024)

Legal Reference: Law 4/2024, of 20 November, passed by the Comunidad de Madrid

- Purpose: To encourage wealthy individuals to pay taxes in Madrid instead of moving their residence elsewhere.

- Tax Basis: Deduction of 20% of the total IRPF liability Our team offers expert tax planning and accounting solutions to maximize your business benefits.

- Applies to: All full tax residents in Spain who are also Madrid tax residents.

- No change in tax status: The taxpayer remains fully subject to Spanish worldwide taxation.

- Conditions: Must have their tax residence in Madrid, and it only applies to the regional portion of the IRPF quota.

In short: this is a tax credit, not a special regime.

Summary: Key Differences

| Feature | Beckham Law (NR) | Mbappé Law (Ley 4/2024) |

|---|---|---|

| Applies to | Inbound workers not resident in Spain | Full tax residents in Spain, living in Madrid |

| Tax Status | Treated as a non-resident | Remain full tax residents |

| Legal Level | National (IRPF Law) | Regional (Comunidad de Madrid) |

| Type of Benefit | Special tax regime | Tax deduction (20% off IRPF liability) |

| Duration | 5 years | Indefinite, while resident in Madrid |

| Global Income/td> | Not taxed (with exceptions) | Fully taxed |

| Target Profile | Foreign executives, workers, directors | High-income residents (e.g. athletes, investors) |

Final Notes

As public servants, and tax attorneys we encourage clarity in taxation. These are general rules, please be aware that any case is different and special rules or norms can be applied. These two rules aim to attract or retain talent and capital in Spain, but they operate in completely separate legal spheres. Confusing them can lead to incorrect tax planning — and unnecessary penalties.